In a rapidly evolving financial landscape, understanding thematic innovation equity has become crucial for savvy investors. During a recent discussion, a market expert shed light on this concept, emphasizing that customary strategies, such as simply aiming not to lose money, fall short in today’s dynamic habitat. Instead, they advocate for a forward-thinking approach centered on identifying and capitalizing on secular trends that promise long-term growth, regardless of prevailing economic conditions.Highlighting past underestimations of transformative technologies like the iPhone and the internet, the expert argues that strategic investment hinges on recognizing the narratives that drive stock performance.Among these narratives, Artificial Intelligence (AI) stands out as a pivotal factor in shaping future market dynamics, particularly as we look ahead to 2024 and beyond. The conversation reflects a broader shift in investment strategies, one that prioritizes innovation and evolving themes over conventional metrics, underscoring the need for a keen eye on market trends to secure robust returns.

The Future of Thematic Innovation Equity: Identifying Long-Term Trends

As the landscape of investment continues to evolve, it is indeed essential to recognize the core areas that indicate potential growth. Key drivers of thematic innovation equity can be categorized into distinct sectors, which include:

- Artificial Intelligence: The rapid advancement of machine learning and neural networks is integrating AI deeper into various industries, thereby enhancing productivity and efficiency.

- Renewable Energy: With global emphasis on sustainability, investment in green technology and renewable energy sources is surging, presenting opportunities for long-term gains.

- Healthcare Innovation: Cutting-edge biotechnology and telehealth services are revolutionizing patient care, driven largely by demographic aging and increased health awareness.

These sectors not only showcase resilience against economic fluctuations but also signify an ongoing conversion in consumer behaviour and expectations. Investors should pay attention to the evolving narratives within these domains, as emerging technologies and societal shifts are likely to unlock unique investment pathways, all while requiring a focus on adaptability to secure favorable outcomes across varying market conditions.

Harnessing the Power of Artificial Intelligence: Key Insights for Investors

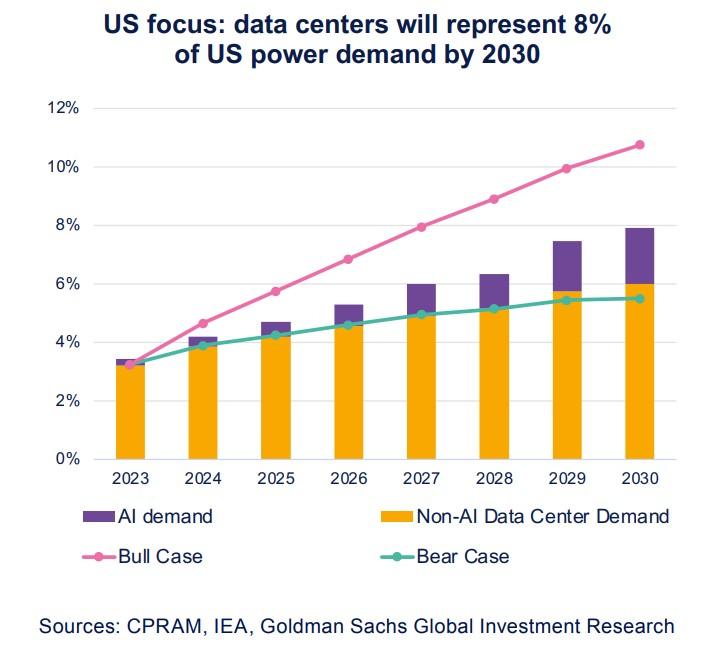

The projected surge in demand for AI technologies presents a significant opportunity for investors seeking to capitalize on the next wave of digital transformation. Industry experts highlight several trends that are fueling this growth, including:

- Increased Adoption across Sectors: Businesses are integrating AI into operations, from customer service chatbots to supply chain optimization, indicating a broad application potential.

- Investment in AI Startups: Venture capital is flowing towards AI startups, showcasing confidence in innovative solutions that solve real-world problems and improve efficiency.

- Government and Institutional Support: Initiatives aimed at boosting AI research and development are gaining traction, with funding from both public and private sectors serving as a catalyst for advancements.

As the market evolves, investors should look for companies that not only embrace AI but also demonstrate a enduring business model capable of adapting to technological advances. Monitoring metrics such as implementation timelines, competitive positioning, and customer feedback can provide insights into a company’s readiness to leverage AI’s full potential.Understanding these dynamics will be crucial for positioning portfolios to absorb the expected growth in this transformative industry.

Building the Infrastructure for Growth: The Role of Enabling Technologies

To support the anticipated growth in AI demand,a robust framework of enabling technologies is critical. These technologies facilitate seamless integration and utilization of AI across various applications, expanding its reach and effectiveness. Key elements include:

- Cloud Computing: Enhanced data storage and processing capabilities enable organizations to leverage AI algorithms more efficiently, promoting scalability and flexibility.

- Big Data Analytics: The ability to gather and analyze vast amounts of data ensures that AI systems can learn and adapt quickly, leading to more accurate predictions and better decision-making.

- Internet of Things (IoT): Connected devices generate real-time data, empowering AI applications with the insights necessary to optimize performance in diverse sectors, from manufacturing to smart homes.

The collaboration of these technologies not only enhances AI capabilities but also broadens its applicability, making it an integral part of organizational strategies. As businesses gear up for this shift,the spotlight will also turn to cybersecurity measures,ensuring that the data being harnessed is secure and compliant with regulations,thereby building trust within consumer bases and ultimately supporting sustained growth in the AI sector.

Navigating Market Uncertainties: Strategic Recommendations for Equity Investments

In the face of heightened market uncertainty, investors should consider diversifying their portfolios with exposure to sectors that are not only resilient but also positioned for sustained growth. A focus on industries where innovative technologies intersect with everyday applications can provide a buffer against volatility. Key areas for consideration include:

- Fintech Solutions: As digital payments and cryptocurrencies gain traction, companies revolutionizing financial services are poised for substantial growth.

- EdTech Platforms: With the surge in remote learning, technologies enhancing educational access and personalization are increasingly attractive to investors.

- Telemedicine Services: Growing reliance on virtual healthcare indicates a long-term shift, presenting unique investment avenues in health-related technology.

Evaluating companies in these sectors requires assessing their scalability, market demand, and adaptability to changing consumer behaviors. Furthermore, investors should be vigilant about macroeconomic factors, regulatory developments, and technological advancements that may impact these industries.By prioritizing entities that not only respond to immediate market needs but also anticipate future trends, investors can strategically position their portfolios for improved resilience and performance in an unpredictable landscape.