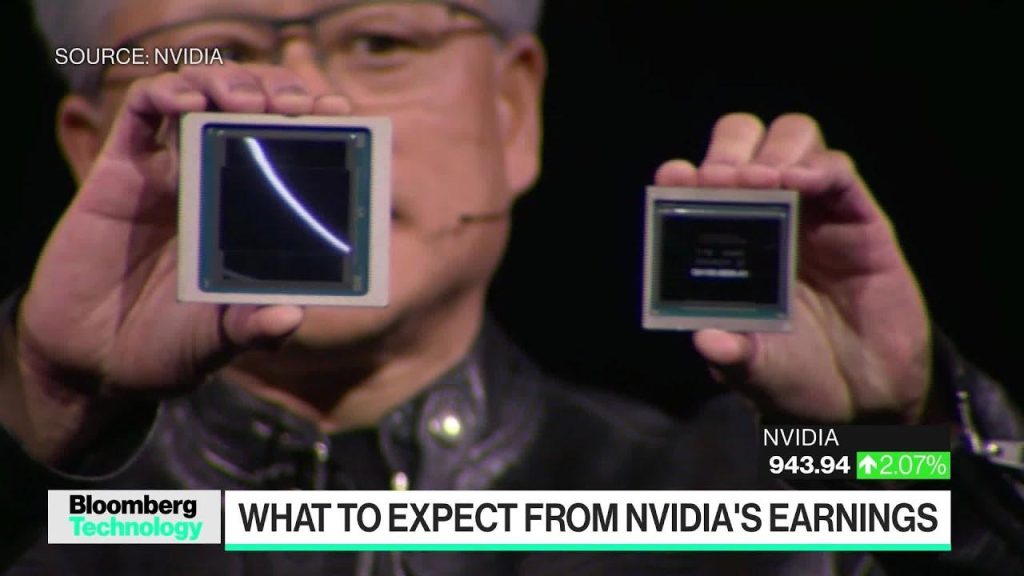

In a remarkable turnaround, NVIDIA is poised to experience revenue growth that exceeds 200% for the upcoming fiscal period, a prospect that has investors and analysts buzzing about the tech giant’s future. With robust demand signals emerging from major cloud providers and hyperscalers, the company’s outlook remains exceptionally optimistic. Recent insights from TSMC, NVIDIA’s primary supplier, indicate a sustained demand trajectory, while other global government entities have also ramped up their capital expenditures. As supply chain issues begin to stabilize,NVIDIA’s ability to meet these surging demands appears increasingly feasible. Moreover, geopolitical factors surrounding chip restrictions are creating unique dynamics in the market, possibly accelerating orders from strategic customers. As NVIDIA continues to dominate the chip landscape,the spotlight remains on its capacity to leverage its technological edge amidst growing competition and high demand.

Anticipating Unprecedented Revenue Growth and Its Implications

NVIDIA’s anticipated revenue surge reflects a notable shift within the tech ecosystem, driven by a combination of unparalleled demand and strategic investments in cutting-edge technologies. Key sectors such as artificial intelligence, machine learning, and gaming are witnessing explosive growth, with cloud computing environments leading the charge. Major players are increasingly integrating NVIDIA’s GPUs into their infrastructures,causing a ripple effect of heightened competition and adoption. This transition not only strengthens NVIDIA’s market position but also serves as a catalyst for numerous tech innovations, enabling a plethora of applications that stretch beyond traditional computing paradigms.

The implications of this revenue ascent extend into both the operational and investment landscape. Companies allied with NVIDIA, including those focusing on developer tools and AI-driven solutions, are likely to benefit significantly. Analysts anticipate shifts in capital allocation, with businesses redirecting funds to optimize their technological frameworks and workforce capabilities. Additionally, this growth trajectory might invite increased scrutiny from regulatory bodies, as consolidation within the semiconductor field raises questions about market monopolies and fair competition.In a rapidly evolving market,stakeholders will need to navigate these dynamics carefully while capitalizing on NVIDIA’s transformative influence.

Rising Demand Signals from Major Cloud Providers and Hyperscalers

As major cloud providers and hyperscalers invest heavily in infrastructure, a new landscape is emerging where demand for high-performance computing is skyrocketing. Companies are increasingly turned towards artificial intelligence and data analytics,driving robust needs for advanced processing capabilities. In this context, tech giants are likely to enhance their partnerships with hardware manufacturers specializing in optimized chips. This is evident as firms like Amazon and Google ramp up their services which, in turn, fuels the necessity for enhanced graphics processing units (GPUs) that can handle complex tasks efficiently. Factors contributing to this trend include:

- Enhanced AI Workloads: Growing reliance on AI-driven applications necessitates powerful computational resources.

- Data Center Expansion: Accelerated investments in new data centers to support increasing user demands.

- Integration of Advanced Technologies: Embracing next-generation solutions enhances operational efficiency.

The shift isn’t solely a function of technological advancements; it’s also about overcoming the challenges faced in previous years, including supply chain disruptions and global chip shortages. Recent resolutions of these supply constraints allow companies to expedite adoption and deployment of advanced technologies, aligning with their expansion strategies.Additionally, geopolitical factors are prompting organizations to secure relationships with tech innovators, ensuring a steady supply of essential components to meet future demands. Capitalizing on these opportunities requires a strategic approach to investment and partnership building, making it increasingly crucial for companies to stay ahead of market shifts.

Supply Chain Resilience and Strategic Architecture Enhancements

In the face of fluctuating market conditions, technology firms are re-evaluating their supply chain models to bolster system resilience. The burgeoning demand for advanced chip technologies has prompted many companies to realign their operational architectures, focusing on improved agility and responsiveness. Important strategies being employed include:

- Diversifying Suppliers: Reducing dependency on single sources mitigates risks associated with geopolitical tensions and shortages.

- Investing in Automation: Enhanced automation within manufacturing and logistics processes helps mitigate delays and improve throughput.

- Strengthening Localized Production: Increasing regional production capabilities lowers transportation costs and speeds up the delivery timeline.

This comprehensive approach not only helps in managing current challenges but also prepares organizations for future demand surges. Moreover, establishing reliable partnerships with key suppliers emboldens companies to innovate without compromising on their supply lines. Insights from internal data trends indicate that firms adopting these changes are better equipped to navigate the high-stakes tech environment, ensuring that they leverage technological advancements while safeguarding against potential disruptions.

Geopolitical Factors and Their Impact on Market Demand for NVIDIA Chips

The interplay between international relations and tech supply chains is notably shifting market dynamics for chip manufacturers like NVIDIA. With recent trade tensions and sanctions impacting semiconductor access, companies are compelled to reassess their technology sourcing strategies. Countries are increasingly focusing on domestic manufacturing capabilities, as seen from initiatives in the U.S. and Europe aiming to bolster local chip production. This geopolitical landscape is not merely a backdrop; it significantly influences investment strategies in the tech sector,prompting businesses to secure their supply chains and diversify partnerships to mitigate risks. Concerning NVIDIA, securing contracts with both government and private entities prioritizing self-sufficiency could lead to an accelerated increase in demand for its chips.

Moreover, the landscape is further elaborate by escalating regulatory scrutiny on foreign investments in technology sectors, particularly in regions prioritizing national security. With policies emerging that scrutinize cross-border transactions, tech firms are stepping up efforts to maintain compliance while maximizing operational efficiencies. In light of these geopolitical factors, companies are finding themselves balancing innovation with the complexities of international relations.As NVIDIA maneuvers through these challenges, its strategic partnerships and adaptability to changing political climates will be critical in shaping its future market demand amidst evolving global scenarios.