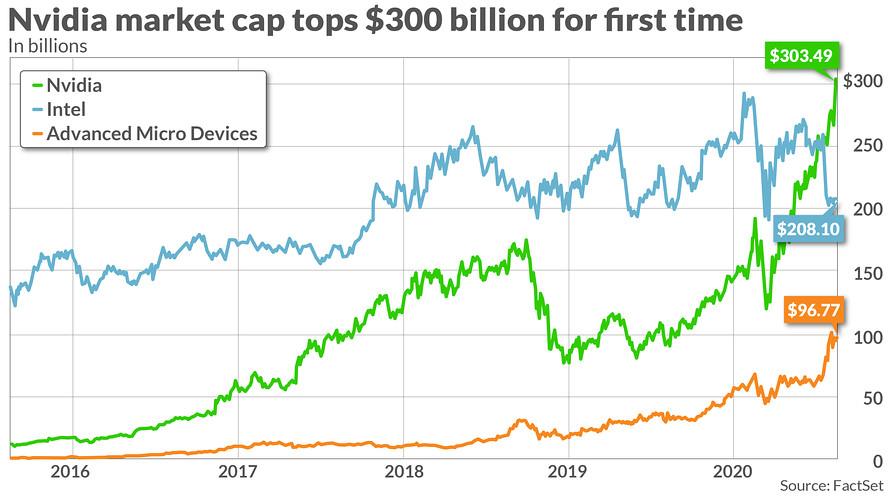

In the wake of a recent crisis that has left many unaccounted for, economic experts, including seasoned money manager Danny, are weighing the implications of the situation on various sectors. While he acknowledges the tragedy of the event and expresses hope for the safe return of those missing, Danny asserts that the immediate economic impact may not be as severe as experienced during the COVID-19 pandemic. Unlike the critical shortages that plagued the automotive supply chain back then, he emphasizes the potential for alternative supply routes to mitigate disruptions, albeit at a higher cost. As inflation remains a hot topic and the Federal Reserve’s rate adjustments loom, Danny’s outlook reflects cautious optimism, especially regarding the tech sector. With Nvidia making headlines for its soaring stock value and important market capitalization gains, the conversation turns towards the dynamics within the tech industry and what they signal for investors moving forward.

Economic Impact of Recent Tragedies: Assessing Immediate and Long-Term Effects

In the wake of recent tragedies, the financial landscape has begun to reveal its complex layers of both immediate and prolonged effects. Experts suggest that while some industries may experience a temporary downturn, the technology sector appears resilient, with companies like Nvidia showing remarkable performance. Factors contributing to this resilience include:

- Innovation and Demand: Ongoing advancements in AI and computing are driving consistent demand for tech solutions.

- Diversification: Many tech firms have diversified their offerings, allowing them to weather economic fluctuations.

- Global Supply Chains: Improved logistics and supply strategies are enabling tech companies to mitigate disruptions more effectively than in past crises.

On a broader scale, some analysts argue that the economic ramifications of tragedies can spark shifts in consumer behavior and market expectations. As businesses recalibrate their strategies, we may witness a reallocation of investment towards sectors viewed as essential or future-proof. In particular, the surge in market capitalization for major players indicates a shift towards:

- Increased Investment in Resilience: Companies may prioritize investments that enhance operational resilience to withstand similar events.

- Sectorial Shifts: Money may flow more freely into sectors perceived as stable, leading to potential imbalances in customary industries.

- Policy Responses: Regulatory adaptations in response to crises could further shape market dynamics.

Navigating Supply Chain Challenges: Lessons from the Pandemic Experience

The pandemic highlighted the vulnerabilities within global supply chains, pushing companies to rethink their operations extensively. Key lessons emerged during this period: companies that swiftly pivoted to enhance digital infrastructure maintained agility, allowing for smoother operational continuity. Some critical strategies identified include:

- Supplier Relationships: Building strong, clear partnerships helped firms navigate shortages and ensure more reliable sourcing.

- Technology Integration: Leveraging technology for real-time monitoring of supply chains proved essential, enabling faster response to disruptions.

- Cross-Industry Collaboration: Many companies found success by collaborating across sectors to share resources and insights to address common challenges.

Moreover, the experience underscored the importance of supply chain visibility and adaptability. Adaptations made during the crisis paved the way for more robust contingency planning, allowing businesses to respond swiftly to unexpected challenges. As firms prepare for future uncertainties, they are now more likely to invest in:

- Automated Solutions: Automation technologies can significantly reduce human error and increase efficiency in handling unforeseen disruptions.

- Localizing Supply Chains: A move towards local sourcing is becoming appealing as it reduces dependency on global logistics.

- Sustainability Initiatives: Companies are increasingly aligning their supply chain strategies with sustainability goals, recognizing that resilience and responsibility go hand in hand.

Inflation Trends and Federal Reserve Actions: What Investors Should Monitor

The impact of inflation trends on investment strategies cannot be underestimated, especially as the Federal Reserve navigates rate adjustments. Investors should remain vigilant regarding key indicators that may illuminate shifts in economic conditions. Among these, the following are particularly notable:

- Consumer Price Index (CPI): Monitor fluctuations in CPI to gauge inflationary pressures on purchasing power.

- Interest Rate Projections: Pay attention to the Fed’s guidance on future interest rate hikes, as these can dramatically impact borrowing costs and consumer spending.

- Labor Market Indicators: Watch employment rates and wage growth,which are closely tied to inflation and overall economic health.

Furthermore, as tech stocks, particularly those like Nvidia, surge, market sentiment surrounding inflation and interest rates can create diverse opportunities across sectors. It’s crucial for investors to analyze whether these gains are sustainable or whether they signal an adjustment phase for the tech industry. Key areas of focus should include:

- Valuation Metrics: Assessing if current valuations align with long-term growth prospects amid an evolving economic environment.

- Sector Rotation: Be prepared for potential shifts away from growth-oriented stocks to value-oriented investments as interest rates rise.

- Global Economic Trends: Understanding how international inflation patterns and central bank policies could influence domestic market stability.

The Rise of Nvidia: Market Dynamics and Future Growth Considerations

Nvidia’s recent ascent in market capitalization is fueled by a combination of advanced technological innovations and a strategic embrace of artificial intelligence across multiple sectors. The company’s ability to deliver powerful GPUs optimized for AI workloads has solidified its position as a key player in the tech industry. As organizations increasingly rely on AI for data processing and analytics, Nvidia is poised to benefit from sustained demand and rapid adoption of its products. This shift is further enhanced by:

- Partnerships with Leading Enterprises: Collaborations with major firms in diverse fields like automotive and healthcare enable Nvidia to expand its market reach and drive product development.

- R&D Investment: Continuous investment in research and development fuels innovation, allowing the company to stay ahead of competitors and create next-generation technologies.

- Scalability of Operations: Nvidia’s strategic focus on scalable solutions positions it favorably to meet the growing demands of cloud computing and edge computing applications.

Looking ahead,market analysts predict that Nvidia’s growth trajectory may prompt further shifts in investment patterns within the tech realm. The surge in market valuation has not only attracted attention but also initiated discussions around potential regulatory scrutiny and competitive landmarks. As tech stocks fluctuate,investors will likely consider several pivotal factors,including:

- Market Penetration Rates: Observing how Nvidia and its competitors adapt to rising market saturation will be crucial for assessing future profitability.

- Innovative Product Pipeline: Analyzing the viability of upcoming product launches and their potential market impact will help gauge continued investor confidence.

- Geopolitical Influences: Factors such as trade policies and international relations could alter operational dynamics and market performance for Nvidia and similar firms.